Conventional Loan vs. Revenue Advance

Small businesses are the engine that drives the U.S. economy. But, taking the time to find funding while managing all of the other important facets of your business can be downright frustrating.

The benefit of an easier qualification process is what makes a revenue advance all the more attractive of a funding solution vs a conventional loan.

Understand Financing Options

Though just over 20% of small businesses use conventional loans from the large banking institutions as a primary source of business funding, those are becoming harder to access. This is particularly true for small businesses and startups. As such, many small businesses are seeking alternative funding sources. Given the constant ebb and flow of consumer spending, it may be a challenge for businesses to maintain the minimum amount of collateral and pristine credit score often required by the large financial institutions.

Also, the financing process for conventional loans can drag on for months. Meanwhile, even the most well managed small business tends to need a swift uptick in capital during a seasonal slowdown. You still have employees to pay, inventory to maintain, and marketing campaigns to launch.

In contrast, a merchant cash advance — or a revenue advance — is a method of funding that is ideal for businesses who manage a high rate of return through future revenue. This is not a loan. You contract to split a percentage of your credit or debit card revenue in exchange for a lump sum advance.

Personalized. Simple. Quick. Efficient.

Quick Loans Direct believes that speed matters.

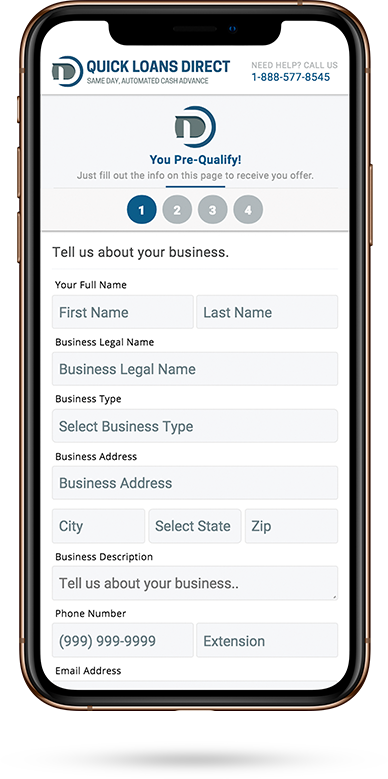

That’s why since 2015, Quick Loans Direct has built a model designed to get business the working capital they need in record time. When opportunity knocks the last thing a business owner wants to deal with are huge piles of paperwork and unrealistic timelines. Our seamless online application generated an instant pre-approval for a fast business loan in under 5 minutes. Funding can then happen within 4-24 hours.

That’s why since 2015, Quick Loans Direct has built a model designed to get business the working capital they need in record time. When opportunity knocks the last thing a business owner wants to deal with are huge piles of paperwork and unrealistic timelines. Our seamless online application generated an instant pre-approval for a fast business loan in under 5 minutes. Funding can then happen within 4-24 hours.

Simply start the online application – takes about 5 minutes to complete

Simply start the online application – takes about 5 minutes to complete Upload 3 months of bank statements

Upload 3 months of bank statements Upon approval, complete an online check out and receive funds within a few hours

Upon approval, complete an online check out and receive funds within a few hours